In any fight in the western Pacific in the coming decades, the Navy is likely to run out of gas. Despite the United States becoming a net petroleum exporter in 2019, the West Coast remains dependent on imported oil. And the U.S. national refined products supply is limited and not configured to support a major conflict with China, because crude and refined petroleum products are not located strategically to support warfighters in the Pacific.

Across the Navy, fleet and ship commanders have a baseline knowledge of how refined fuels are transferred from a shipping terminal to ships and from ships at sea to warfighters, but they lack knowledge about supply capacity limitations and vulnerabilities for the F-76, JP-5, and JP-8 distillates that fuel military ships, aircraft, and ground vehicles.

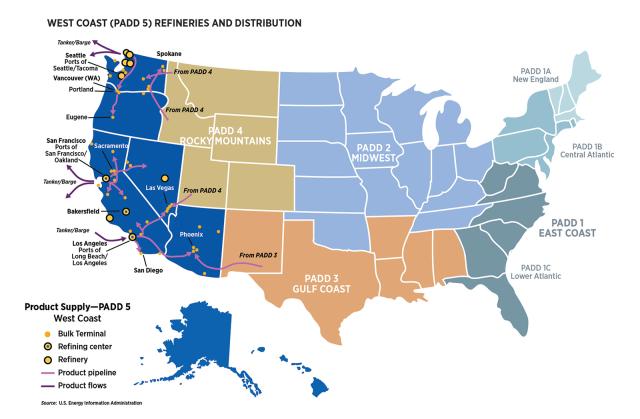

The United States has five Petroleum Administration for Defense Districts (PADDs), shown below. PADD data originally created to manage World War II fuel rationing is used today to analyze and track refining capacity, production, imports, exports, and inter-PADD pipeline movements. The Strategic Petroleum Reserve (SPR), managed by the U.S. Department of Energy (DOE), ensures the national crude supply is uninterrupted during any disruption that threatens the U.S. economy.

China has similarly been building its own reserve capacity. Bloomberg News reported in February that China had achieved a reserve capacity of 100 days, better than the 90-day reserve goal it had set previously. But the actual capacity of China’s reserves is uncertain, because China is not a member of the International Energy Agency and therefore is not required to report such data. China last released reserve data in 2018, reporting that, at that time, it had 276 million barrels of petroleum. The United States has the world’s largest SPR, with up to 645 million barrels of crude oil waiting to be refined and transported for distribution, most stored along the Gulf Coast, where 52 percent of U.S. refinery capacity also is located. However, because of a lack of pipelines, oil from the SPR can be transported to the West Coast only on commercial U.S.-flag ships. Much of the non–Gulf Coast SPR capacity is on the East Coast.

The West Coast is geographically isolated from the other PADDs. RBN Energy Director of Research, Commodities, and Energy Sandy Fielden notes: “The California refining market has long operated like an island within the U.S. and has so far received few supplies from new domestic production.” No pipelines cross the Rocky Mountains to deliver Midwest crude to California, Oregon, or Washington, and the capacity to transport crude from the Gulf Coast to the West Coast is low. Worse, using that capacity would cut off and isolate crude supplies in Arizona, Nevada, and New Mexico.

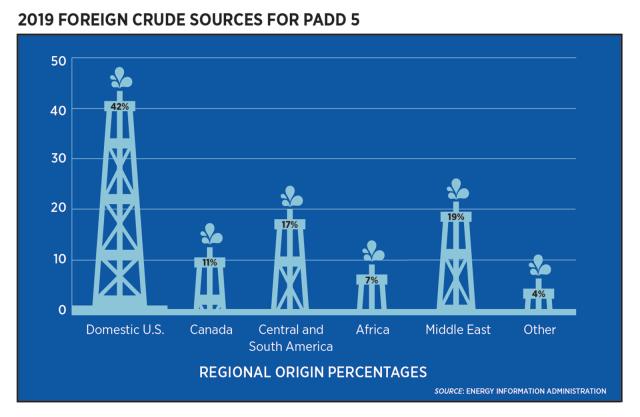

PADD 5, the district that includes Washington, Oregon, California, Nevada, and Arizona, depends increasingly on foreign oil for its refineries. In 1981, less than 10 percent of crude refined in PADD 5 came from imports. In 2019, more than half did. The figure above shows the sources of the imports. It takes 45 days for oil to travel from Saudi Arabia to West Coast refineries, compared with 21 days from Asia and 10 days from the Gulf Coast (the latter through the Panama Canal). Within PADD 5, a lack of pipelines and the Jones Act’s requirement that only U.S.-built, -flag, -owned, and -crewed ships can transport goods between U.S. ports further restricts movement of oil.

Changes to the supply of crude oil from foreign suppliers and Alaska cannot be absorbed. West Coast refining capacity currently has a 90 percent demand, and PADD 5’s inventories have been constant over the past two years. These factors indicate that the current system is balanced and additional load or a decrease in input likely would be disruptive.

If a high-end fight breaks out in the western Pacific, the United States will need to maintain steady-state refined-product production on the West Coast, even in the event of disruption to crude oil supply. It will also need to be able to surge transportation of those refined products from the west coasts of North and South America.

To prepare, the country should increase crude oil storage and establish new SPR capacity on the West Coast. The government should evaluate the feasibility of crude-oil pipelines from western Texas or the Midwest and refined-product pipelines from the Gulf Coast to California. It should also evaluate crude oil production capacity in Alaska and on the west coasts of Central and South America to diversify supply and reduce dependence on imports from farther afield. The United States must focus on ensuring the industrial base is cyber hardened to withstand attacks to information technology (as seen with the Colonial Pipeline ransomware attack) and industrial control systems (think Stuxnet), to prevent interruptions of critical resources.

Imagine it is not you at a gas pump, but Navy tankers sitting off the West Coast while conflict with China rages in the western Pacific. Today’s production, refining, and transportation system functions, but it is precariously balanced. Without advance planning and improvements now, it could easily break once the shooting starts.